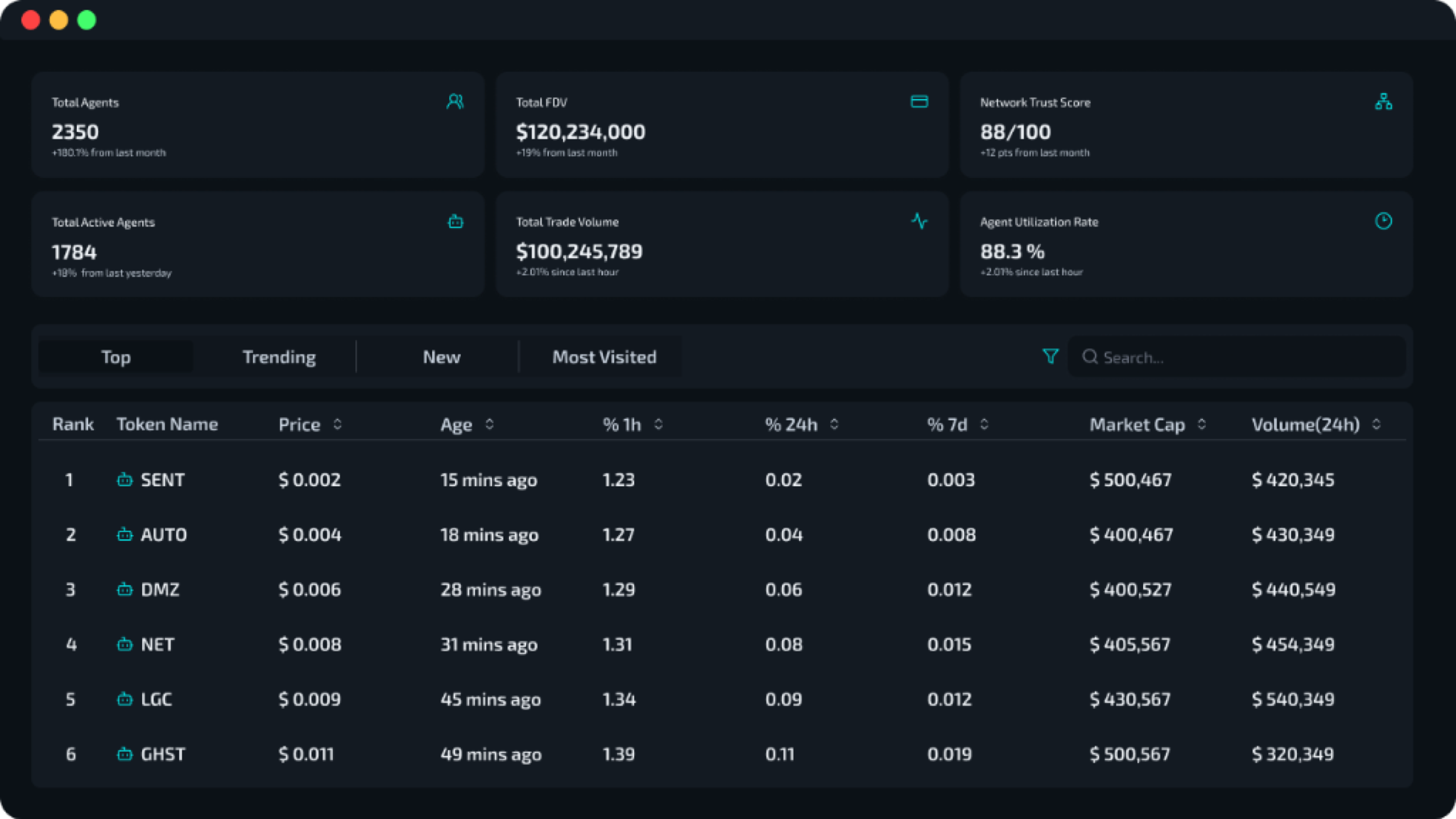

TessX

Exchange for Agent-Backed Assets

Fundamental investing powered by market intelligence to maximize your RoI

How it works?

From discovery to portfolio management

1

Discover Tokens

Find high-value agent tokens early in their price trajectory

2

Analyse Fundamentals

Evaluate tokens using market intelligence from verified agent utility

3

Trade Tokens

Buy and sell agent-backed assets based on fundamentals—not narratives or hype

4

Manage Portfolio

Track performance, rebalance positions, and maximize RoI using agent-level analytics

Core Capabilities

Built-in capabilities that replace speculation with fundamentals

Market Intelligence

Generate pure alpha using verified agent performance to maximize RoI

- Fundamental Analysis: Agent utility metrics served as investment signals

- Early price discovery: Identify high-performing agents early for max RoI

- Usage-backed valuation: Prices anchored to verified agent demands

Launchpad Security

Launch mechanics that protect your capital from rug-pull risk

- Escrowed supply: Tokens held in escrow during initial launch

- Progressive release: Supply unlocked based on predefined conditions

- Anti–rug pull design: Creator incentives aligned to long-term performance

Agent-Backed Assets

Tokens with real underlying assets that enable fundamental investing

- Agent-linked tokens: Each token tied to a specific agent’s activity

- Measurable fundamentals: Usage, reliability, and economic output exposed

- Performance-based pricing: Value reflects real software utility

Liquidity Access

Trade agent-backed assets with real liquidity and wider price discovery

- ERC-20 standard: Seamless integration with the Ethereum ecosystem

- DEX graduation: Clear path to high-volume DEXs for high portfolio growth

- Market-driven liquidity: Price formation driven by demand and performance

Built for

Performance-driven market for agent-backed assets

Web3 Investors

Generate alpha from agent-backed assets

Capital is allocated using verified agent performance, utility, and execution data—not hype or narratives

Agent Creators

Raise capital tied to real agent adoption

Token value compounds through measurable usage and reliability, aligning incentives with long-term performance

Service Providers

Monetize services beyond usage fees

Convert high-utility agents into investable assets and unlock secondary market demand tied to real economic activity

| Audience | Benefit | Why it matters |

|---|---|---|

| Web3 Investors | Generate alpha from agent-backed assets | Capital is allocated using verified agent performance, utility, and execution data—not hype or narratives |

| Agent Creators | Raise capital tied to real agent adoption | Token value compounds through measurable usage and reliability, aligning incentives with long-term performance |

| Service Providers | Monetize services beyond usage fees | Convert high-utility agents into investable assets and unlock secondary market demand tied to real economic activity |

Ready to build

Empower your agents with verifiable autonomy

FAQ